Immediate Action

Pay as soon as possible to minimize penalties. A prompt catch-up payment stops further penalty accrual, though you’ll still face a penalty for the late payment.

Payment Methods

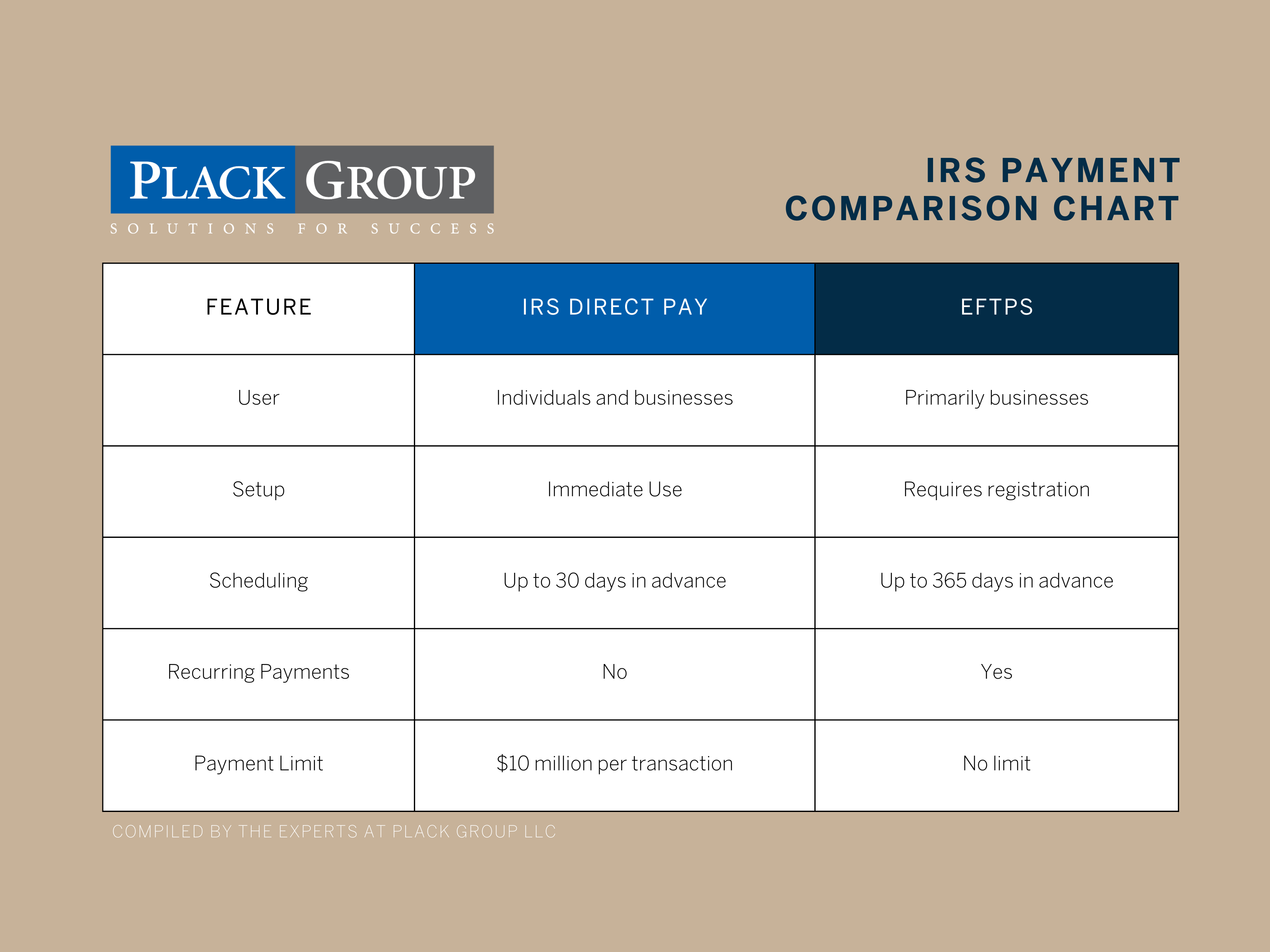

IRS Direct Pay

- Free and secure for both personal and business tax payments

- No sign-up required

- Allows changes or cancellations within 2 days of scheduled payment

Electronic Federal Tax Payment System (EFTPS)

- Ideal for businesses

- Requires registration but offers more features

- Schedule payments up to 365 days in advance

Check Payment (Use Caution)

- Acceptable but carries risks due to increased check fraud

- If using, follow these precautions:

- Use an opaque envelope

- Send via certified mail for proof of mailing and receipt

Preventative Measures

To avoid future missed payments, mark these 2025 estimated tax deadlines in your calendar:

- April 15, 2025

- June 16, 2025

- September 15, 2025

- January 15, 2026

Choosing the Right Payment Method:

Who We Are

The Plack Group works with clients in the areas of wealth-management, tax strategy, and business solutions through our coaching, planning, and accounting services.

Our clients look to transform the way they do business and embrace unprecedented personal and business development, balancing their personal and professional lives with a sense of purpose.

As individual and business accountants based in Bel Air, Maryland we partner with clients across the United States. At Plack Group, we treat our clients with the samecare and consideration whether you are located next door or on the next coast. We specialize in complex tax situations, uncovering hidden deductions and crafting strategic financial solutions.

Our highly experienced team of CPAs, accountants, and consultants go beyond tax optimization by partnering with you to align your business success with personal goals. We dive deep into your unique financial landscape, transforming your journey from surviving to thriving.