By Emily O’Neil

What is a Feedback Loop?

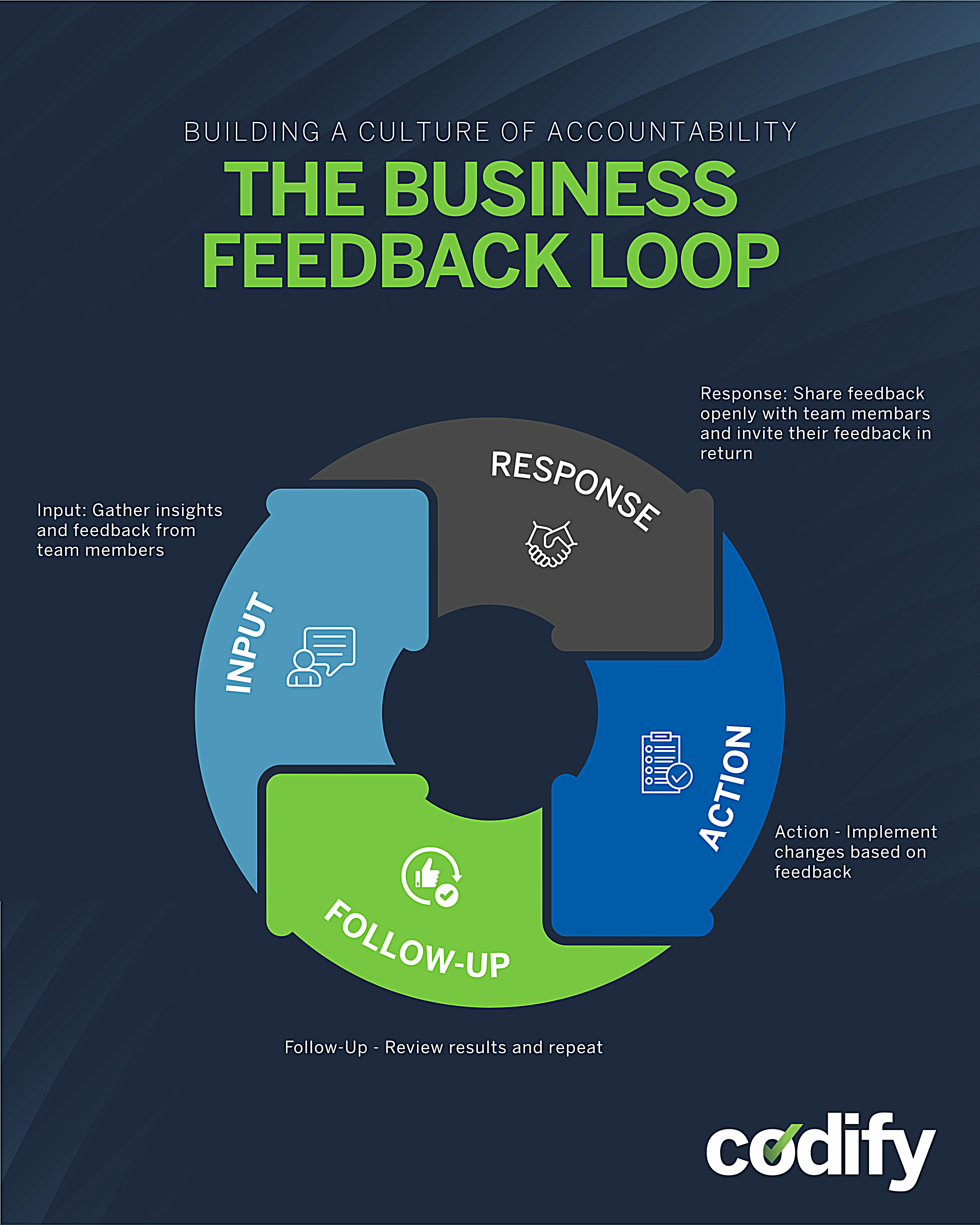

A feedback loop is a structured, ongoing exchange of feedback (positive, negative, and constructive) between owners and team members. This process builds a culture of openness, accountability, and continuous improvement.

Core components:

- Input: Gathering insights or comments from any party.

- Response: Sharing feedback with the relevant person.

- Action: Making changes based on feedback.

- Follow-Up: Reviewing results and continuing the cycle.

Benefits of feedback loops:

- Identifies strengths and areas for improvement

- Aligns expectations and goals

- Builds trust and transparency

- Fosters accountability and engagement

Embedding feedback loops into regular routines ensures everyone feels heard and valued. This best business practice is more than just occasional performance reviews or casual check-ins. It’s a deliberate system that encourages regular dialogue, helping to align expectations, recognize achievements, and address challenges promptly. When team members feel heard and valued, engagement and morale improve. Likewise, when business owners receive honest feedback, they gain insights that can drive better decision-making and leadership growth.

Why a Feedback Loop Matters

- Goes beyond occasional reviews or check-ins

- Encourages regular, open dialogue

- Helps align expectations and recognize achievements

- Boosts engagement and morale by making team members feel heard

- Provides owners with insights for better decisions and leadership growth

- Breaks down barriers, reduces misunderstandings, and fosters trust

Implementing Feedback Loops in Your Business

Create recurring opportunities for feedback:

Weekly

- Team Huddles: Short meetings for updates, wins, and concerns.

- One-on-One Check-Ins: Informal sessions for personalized feedback and input.

Quarterly

- Structured Review Sessions: Formal meetings to review progress, discuss challenges, and set objectives.

- Skill Development Discussions: Identify training needs and growth opportunities.

Annually

- Performance Evaluations: In-depth reviews of achievements and areas for improvement, with two-way conversation.

- Strategic Planning Meetings: Use feedback insights for business planning.

- Recognition and Rewards: Celebrate successes publicly to motivate excellence.

Building Accountability and Culture

- Regular feedback intervals create built-in accountability and reduce surprises

- Normalizes open communication as part of daily operations

- Owners who seek and respond to feedback inspire authentic engagement

- Strengthens relationships and collaboration

Creating a feedback loop is a strategic investment in your business’s health and growth. By establishing regular, open communication, you foster trust, accountability, and continuous learning, enhancing team performance and positioning your business for long-term success.

Owners need to embrace feedback as a vital leadership tool. When feedback flows freely in both directions, workplaces become thriving communities where everyone contributes to shared success. Implement these practices today to build a stronger, more connected business tomorrow.

Plack Group: Who We Are

Founded on a simple yet powerful principle – helping people – Plack Group is more than just an account firm. We create effective solutions that embody your core values and beliefs. From our home in Bel Air, Maryland, we’re proud to serve kind and dedicated clients across the United States.

We’ll say what others might not: we love our clients. Our commitment extends far beyond tax returns and financial analysis. We offer the same thoughtful guidance and strategic advice we’d give our own family.

At Plack Group, we take a highly personalized approach to helping our clients succeed. No two businesses or people are alike, so why would we treat them that way? We specialize in complex tax scenarios for individuals and business owners. Our experienced team of CPAs, accountants, and consultants find solutions and tax strategies others miss. If you’re a high-achiever, forward-thinker, actively engaged in your business, and want to prioritize your family, Plack Group is your right fit. We work with you to create a strong financial future that reflects your personal faith, values, and beliefs.